Step by Step Guide to GST Registration for Amazon Seller

Goods and Services Tax is an important part of business, and registering as an Amazon seller is mandatory. GST simplified taxation, unifies markets, and allows you to sell legally on Amazon. This comprehensive guide will take you step-by-step through registering as an Amazon seller for GST, from creating the GST application to verifying and submitting your application.

Step 1. Determine your eligibility

Before beginning the registration process, as an Amazon seller, your business must meet certain conditions for registration under GST. According to the GST Council guidelines, you are required to register if:

Your aggregate turnover exceeds Rs. 40 lakhs (Rs. 10 lakhs for Special Category States).

You sell goods and services within India.

GST does not allow you to claim any tax exemptions.

Step 2: Gather the required documents

Gather all the documents needed for GST registration. Amazon sellers will need to:

PAN card of the business entity, and its authorized signatories

Aadhaar Card for the Authorized Signatories

Proof of address is required (e.g. electricity bill, lease agreement, etc.). ).

Bank account details (Bank account number, IFSC code, etc. ).

Digital Signature Certificates (DSC) are issued to authorized signatories.

Step 3 – Generate GST Application Form

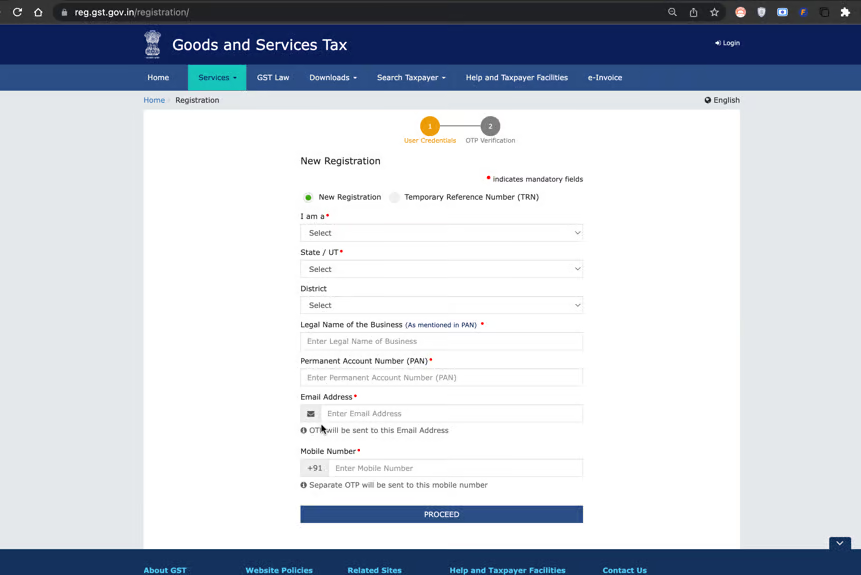

Follow these steps to register for GST:

Visit the official GST Portal at www.gst.gov.in.

Select “Registration” from the “Services Tab.”

Select “New Registration” in the drop-down list.

Enter your state and district by selecting “Taxpayer”.

Enter the permanent account number (PAN) and the legal name of your business.

Please provide a valid mobile number and email address for communication.

You will receive a One-Time Password on your mobile number or email. Enter the OTP in order to continue.

Step 4 – Fill out the GST Application Form

You must fill in the GST application form with accurate details. Each section of the form requires specific information:

Business details: Enter legal name, trade names (if any), and Aadhaar information of authorized signatories. Please provide information on the company constitution, primary place of business and any additional locations (if applicable).

Goods & Services: Mention details about the goods and services that you provide. Include the appropriate Harmonized System of Nomenclature code (HSN) for goods, and Services Accounting Codes (SAC) (for services)

Bank account details: Please provide the bank account information of the business entity including the account number and IFSC codes.

Authorization: Add authorized signatories with their Aadhaar numbers. The Digital Signature Certificates (DSC) for the authorized signatories should be registered.

Verification: After entering all the necessary details, verify electronically the application by using Aadhaar based OTP or Digital Signature Certificate.

Step 5: Register Digital Signature

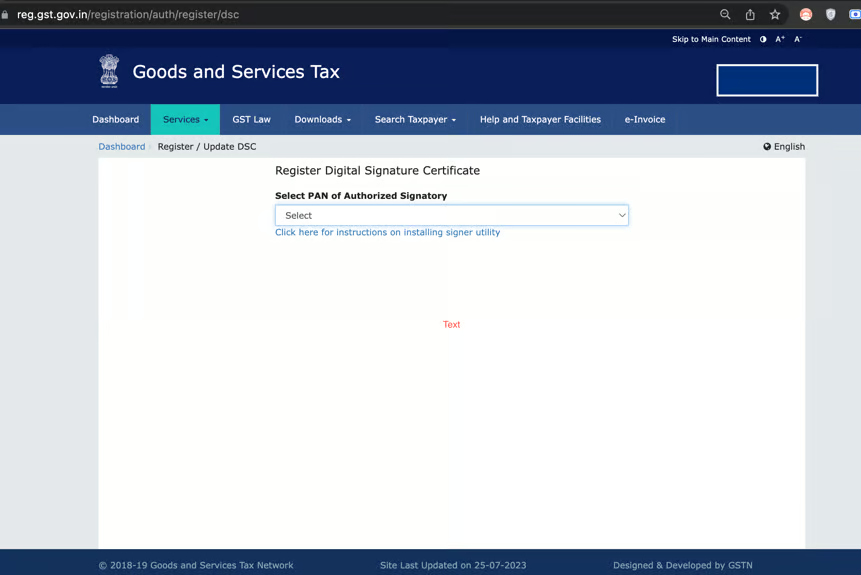

Follow these steps to register your Digital Signature Certificate.

Obtain a Digital Signature Certificate (Class 2 or Class 3) from a government-approved Certifying Authority (CA).

Install DSC on your computer using USB tokens or smart cards readers.

Access the GST portal and navigate to the “Register/Update DSC” option under the “Profile” tab.

To register your Digital Signature Certificate, follow the instructions on the portal.

Step 6: Check and submit the application

Verify and submit the GST Application Form after you have filled in all of the details and attached the Digital Signature Certificate. Verify the application by using one of the methods below:

Aadhaar Verification: An OTP will be sent to your mobile number associated with Aadhaar. Enter the OTP in order to verify your application.

Electronic Verification code (EVC): You can choose EVC if you don’t want to use Aadhaar OTP. The EVC is sent to your registered email and mobile number. Enter the EVC in order to verify your application.

Digital Signature Check: The application will be verified automatically using your Digital Signature if you have registered the Digital Signature Certificate.

Submit the application after verification. Upon successful submission, you will receive a Reference Number for the Application (ARN). Save the ARN for future use.

Step 7 – Acknowledgement and Approval

The tax officer in charge will examine the application once it is submitted and perform any necessary verification. You will receive your GST registration certificate after the successful verification.

Conclusion

When you start selling on Amazon, it is mandatory to register yourself for GST to abide by the legal requirements and run your business without any hiccups. The registration process on the GST portal is easy but needs the right details. It is advisable to have all the documents, that are needed for the registration at hand before you start the process. After the registration process, one is in a position to sell various products using the Amazon marketplace. This will help to grow your business in India and your own. To avoid any complications with the tax laws, detailed records should be kept, GST returns filed regularly and potential amendments in the GST laws should be noted frequently.

Additional Reading

For more insights into optimizing your Amazon business, check out: